Firm-specific and Macroeconomic Determinants of Capital Structure: Evidence from Pharmaceutical Industry in Bangladesh

K.M. Zahidul Islam

Institute of Business Administration, Jahangirnagar University, Dhaka

Meskat Ibne Sharif

Bangladesh University, Dhaka

Md. Nurul Hoque

Department of Economics, jahangirnagar University, Dhaka

Khulna University Business Review – A Journal of Business Administration Discipline, Khulna University, BD

Volume 11, Number 1 & 2, January to December 2016, Pages 43-57

DOI: 10.35649/KUBR.2016.11.12.4

Published: May 2018

Published Online: July 2019

Abstract

Purpose: This study explores the significance of firm-specific and macroeconomic factors to explain variation in leverage using a sample of twenty listed pharmaceutical firms in Dhaka Stock Exchange over a six year period of 2008-2012.

Design: In this study, panel data has been used and both firm specific and macroeconomic factors are analyzed as the determinants of leverage for pharmaceuticals firms in Bangladesh.

Findings: This study employs leverage measure (book leverage) as dependent variable and ten factors (liquidity, profitability, tangibility, debt coverage, growth rate, firm size, GDP growth, and inflation, interest rate, and stock market development) as determinants of capital structure. Around 51% variation in leverage is explained by selected macroeconomic and firm specific factors, while the remainder is explained by unobserved macroeconomic and firm specific differences.

Practical Implication: Estimated results show that GDP growth has significant positive association with the leverage. However, liquidity, profitability, tangibility, sales growth, inflation, interest rates, and stock market development reveal inverse relation with leverage. Finally the results suggest that that both trade-off and pecking order theories can explain financing decisions of listed pharmaceutical firms in Bangladesh.

INTRODUCTION

In spite of extensive research over the last four decades, the theory of the determination of optimal capital structure remains one of the most debatable issues in modern corporate finance and Myers’ eighteen years old question “How do firms choose their capital structure? … We don‘t know”, (Stewart Myers, Presidential Address AFA, Myers 1984, p. 575) still remains unresolved. Determining optimal capital structure has got special attention since the emergence of capital structure theory formulated by Modigliani and Miller (1958; hereafter MM). They showed that under some restrictive set of assumptions (e.g., no corporate and personnel taxes, no transaction costs, symmetric information, complete contracting, complete markets), specifically in the perfect capital market, capital structure decision is irrelevant to firm value. However, when these assumptions are relaxed then the choice of the proportion between debt and equity becomes meaningful. As perfect capital market does not prevail, controversy regarding MM theory is naturally prominent. Consequently, various other theories like static trade-off theory, signaling theory, pecking order theory, and market timing theory have been emerged. However, all these theories emerge because of the divergence in the market structure, operation, size, and nature of the firms worldwide and thus are not accepted universally.

The static trade-off theory states that capital structure is optimal when tax shield benefit of debt exactly offsets financial distress cost of debt (Miller, 1977). In other words, optimal capital structure is obtained when a company balances the present value of tax shield benefits against the present value of the bankruptcy cost of debt. Pecking Order Theory (POT), suggested by Myers & Majluf (1984), states that manager should follow a hierarchy in terms of choosing long-term fund. They asserted that initially a firm should try to obtain fund internally because it is the cheapest sources of capital with lowest risk. Moreover, informational problem and lower sensitivity to valuation error can be mitigated by using internal fund (Jamal et al., 2013).

If internal fund is not sufficient then a firm may initiate to raise external financing through debt and or equity instruments. In extreme situation, when internal fund and debts are not available then firm may rely on equity, which is the most costly and risky security. In contrast, market timing theory states that when the market value of the firm is higher because of the favorable market condition then equity is preferred to debt which is a clear violation of POT. Ross (1977) in his signaling theory stated that debt is linearly related with profitability which also contradicts the POT. The main idea of this theory is that as managers are better informed than shareholders and knows the actual distribution of the firm’s returns, so capital structure gives some indication to the investors about how well insiders are performing. Accordingly, when a firm issues debt it gives a signal that managers are more confident about the generation of higher future cash flows to firm and thereby profitability is linearly related with debt. Agency cost theory, introduced by Jensen & Meckling (1976), affirmed that optimal capital could be found by minimizing agency cost among the stakeholders. However, any of these theories cannot come up with a concrete conclusion about the ways to construct optimal capital structure. In addition, these theories analyze different influential factors of capital structure from diverse facet and reached different conclusions in determining the proportion debt for financing (Miller, 1977). In brief, it is essential to acknowledge that capital structure theories are not universal so far (Muthama et al., 2013).

Previous researches (see Lima, 2009; Sayeed, 2011; Alom, 2013) emphasize solely on the impact of firm-specific variables on the determination of capital structure. But empirical test provides the proof that capital structure choice is equally influenced by macroeconomic variables as well (Muthama et al., 2013). Macroeconomic variables that exert influence on capital structure of a firm includes, among others, inflation rate, GDP growth rate, stock market development, liquid debt, and advantage of tax rate (Booth et al., 2001). Moreover fiscal policy and monetary policy instruments also affect macroeconomic variables and thereby affect the capital structure of a firm. For example, as interest rate on debt is greatly influenced by monetary policy of a country, so does the capital structure of a firm (Muthama et al., 2013). Again, if the probability of expected inflation or money supply increases, then a firm tends to issue less debt (Stephen & Talavera, 2004). Firm specific variables like firm size, profitability, growth, tangibility, non-debt tax shield, debt service capacity, liquidity, and agency cost of equity also influence composition of capital structure and required amount of financing. Previous studies (see e.g., Titman & Wessels, 1988; Rajan & Zingales, 1995; Antoniou et al., 2002; Frank & Goyal, 2009) explored different firm specific determinants of capital structure and admitted their impacts on the choice of financing. In Bangladesh, a good number of studies have examined the impacts of firm specific determinants on capital structure (Lima, 2009; Sayeed, 2011; Alom, 2013). However, the impact of macroeconomic factors on capital structure of any specific industry is relatively unexplored. Given this backdrop, the present paper attempts to carry out an empirical testing, using panel data to determine the firm-specific factors as well as macro-economic factors affecting the capital structure decisions of pharmaceutical companies in Bangladesh. This study also makes an attempt to contribute to the ongoing debate about whether the effects of operating and market performance on firms’ financing decisions are due to trade-off or to pecking order financing behavior. The rest of the paper is organized as follows. Section 2 describes the literature review. Section 3 discusses the data and variables construction. Section 4 deals with the methodology of target capital structure using leverage regressions. Section 5 presents the results and the last section summarizes the findings and concludes the paper.

.

LITERATURE REVIEW

Modigliani & Miller (1958), in their seminal work on corporate capital structure, proposed a theory that still has great influence on modern thinking on corporate capital structure. Despite a mixed reaction among intellectuals about the theory, no one has managed to offer a complete theory explaining what determines capital structure and the mechanism to choose an optimal level of capital for a firm. As a matter of fact, although a good number of empirical studies discussed some firm-specific factors’ impact on financial leverage (Kiran, 2013; Kouki & Said, 2012; Antoniou et al., 2002), different studies identified different determinants in explaining variation in capital structure. It appeared that because of the differences in firm characteristics, industry dynamics, and country characteristics different researchers come up with different factors influencing leverage. On the other hand, capital structure decision is also driven by macroeconomic condition of a country. A very few researches incorporate the influence of macroeconomic variable on the financial leverage of a firm (see Muthama et al., 2013; Kayo & Kimura, 2010).

Amongst the studies conducted previously, there are some common firm-specific variables that influence leverage like tangibility, liquidity, profitability, growth opportunities, agency cost of equity, firm size, debt coverage, non-debt tax shield, bankruptcy risk etc. However, in earlier studies different author defined leverage, the dependent variable, differently. For example, some authors choose total debt to total asset ratio as a measure of leverage (Lima, 2009; Kiran, 2013; Teker et al., 2009), while others use both book leverage and market leverage as a measure of leverage (Kouki & Said, 2012; Antoniou et al., 2002). Kay & Kimura (2011) analyzed capital structure based on some selected determinants and claimed that firm-level characteristics and effort in timing the market act as critical factors that influence the determinants of firms’ capital structure choices (Kayo & Kimura, 2011). They also found two firm-specific variables namely tangibility and size that were significantly and positively related with leverage. The same study also identified a negative relationship between leverage and growth, which is consistent with the findings of earlier studies (Gaud et al., 2005; Frank & Goyal, 2009; Hovakimian & Li, 2011; Baker & Wurgler, 2002; Lemmon et al., 2008). Apart from firm specific variables, they also found negative effects of stock market development and real GDP growth rates on firm’s leverage.

Bas et al. (2009) examined the determinants of capital structure incorporating both macroeconomic variables as well as firm-specific variables for developing countries based on the survey data of World Bank and the study revealed that tangibility is negatively related with leverage, which corroborates the findings of Alom (2013) in a study on Bangladeshi firms’ capital structure choice. They also found that profitability is negatively related with leverage which is consistent with the findings of Shah & Khan (2007), in an analysis of the determinants of capital structure of Pakistani firms. In terms of macroeconomic variables, GDP per capita and GDP growth rate were found to be positively related with leverage. On the other hand, inflation exerted a negative impact on leverage. However, the interest rate is found to be positively related with leverage which is unusually expected. Tax is found to be positively related with leverage and thereby supporting the static trade-off theory that relies on the notion that firms should use more debt to obtain more tax shield from the increased use of debt. Hussain (2011) analyzed capital structure determinants of the textile industry in Pakistan. The study found that growth and tangibility are significantly and positively related with leverage. Size is positively related with leverage and profitability is significantly and negatively related with leverage and thereby supporting POT of leverage. In terms of macroeconomic variables nominal interest rate exerted significant negative impact on leverage. GDP growth is significantly and positively related with leverage and they claimed that during the period of growth firms manager expect more investment opportunities and thus they require fund for financing fixed asset to capitalize this growth (Hussain, 2011; Sayilgan et al., 2003).

Yeh & Roca (2010) investigated the influence of macroeconomic variables and their relation with firm-specific variables to determine the capital structure of the textile, plastics and electronics industries in Taiwan. They found that macroeconomic factors have significant positive impact on growth opportunities but the results become reversed when macroeconomic conditions worsen. Stephan & Talavera (2004) analyzed the relationship between optimal debt and macroeconomic volatility and their study revealed that when macroeconomic variability like inflation increases firms reduce the use of optimal level of debt. Gulati & Zantout (1997) and Bas et al. (2009) also reported that inflation rate inversely affects leverage decision of a firm. They found an inverse relationship between money growth and the level of debt. It is rational because money growth influences interest rate which has an impact on the cost of debt. Çekrezi (2013) analyzed the influence of firm-specific and macroeconomic variables on capital structure decision using a sample of 53 non-listed firms over the period of 2008-2011. The study claimed that some firm-specific variables like tangibility, liquidity, and size have significant positive relationship with leverage while profitability has significant negative relationship with leverage which supports the POT of leverage. On the other hand, macroeconomic variable like GDP growth has a significant positive relationship with leverage. GDP growth rate is found to be positively related with leverage in the study of Bas et al. (2009) but GDP growth rate is also found to be negatively related with leverage in the studies of Gurcharan (2010) and Dincergok and Yalciner (2011). Harris & Raviv (1991) and Gaud et al. (2005) found a positive relationship between leverage and firm size as well as tangibility. Jõeveer (2006) analyzed firms from nine Eastern European countries by incorporating firm-specific, institutional, and macroeconomic variables that determine leverage. They found that for large listed firms, firm size is positively related with leverage and for unlisted firms profitability is negatively related with leverage and they deduced that unlisted profitable firms take lower debt. They also found that tangibility is negatively and significantly related with leverage which is consistent with the findings of Titman & Wessels (1988). GDP growth was positively related to leverage because it is a representative of growth opportunity and investment opportunity sets of a firm (Smith & Watts, 1992). Therefore available literature gives us enough evident that different firm specific and macroeconomic factors affect capital structure in different ways. However, there are few papers available on this relevant field in the context of Bangladesh that deals with both firm specific and macroeconomic factors together to explain the determinants of capital structure. This paper is expected to have a significant contribution towards measuring the impact of both firm specific and macroeconomic factors on firms’ capital structure in Bangladesh.

.

DATA COLLECTION, VARIABLES DESCRIPTION AND MEASUREMENT

The present study used both firm-specific and macroeconomic factors to explain variation in leverage using a sample of twenty Dhaka Stock Exchange listed pharmaceutical companies over a six year period of 2008-2012. We have selected pharmaceutical sector by considering the attractive and consistent growth of this sector, export contribution, and data availability. We used judgmental sampling to choose 20 pharmaceutical companies and the sample was taken based on consecutive positive performance (measured by EBIT/TA), information accessibility, and availability of satisfactory accounting information. We have chosen leverage (LEV) as the dependent variable and ten other independent variables which are both firm-specific and macroeconomic. Firm specific independent variables include liquidity, profitability, tangibility, debt coverage, growth rate, and size. On the other hand, macroeconomic variables include inflation, interest rate, GDP growth rate, and stock market development. We collected data from 2008 through 2013, totaling 120 observations for all firms. However, due to missing values, the number of observations was below 120 by the time we analyze the complete model for some variables.

In the following section we have discussed about dependent and independent variables in which some are firm-specific and some are macroeconomic:

DEPENDENT VARIABLE

Leverage: To define leverage some researchers use total debt to market value of asset (Alom, 2013; Chkir & Cosset, 2001), while some other researchers (Kiran, 2013; Lima, 2009) use book value of total debt to book value of total asset. Some researchers use both book leverage and market leverage to define leverage (Kouki & Said, 2012; Antoniou et al., 2002). However, any methods other than book value of debt ratio could not be used as a measure of leverage in our present study because of data unavailability.

INDEPENDENT VARIABLE

Liquidity: Liquidity represents current assets like cash, marketable securities, and accounts receivable which can be used to meet short-term obligations. If a firm has more liquid assets then it may expect to create positive cash flows and thus it will be able to fund their investment expenditure (Alom, 2013). As a highly liquid firm may be able to generate internal fund which can be used to finance profitable investments, thus liquidity can be negatively related with leverage. In the present study liquidity is calculated by dividing current asset by current liability.

Profitability: Profitability represents financial position of an organization. Profitable firm can finance their investment at lower cost. The POT (Myers & Majluf, 1984) suggests that firms choose their financing methods based on a specific hierarchy. As profitable firms can finance their investment from retained earnings, so it may issue less debt. Thus, it can be said that profitability is negatively related with leverage. However, TOT suggests that debt is merely the instrument that shields earnings from tax. So, profitable firm can shield their profit from tax by using more debt in the capital structure. Thus TOT posits a positive relationship between profitability and leverage. Moreover, free cash flow (FCF) hypothesis theory (Jensen, 1986) also suggests a positive relation between profitability and debt. We measure profitability as a ratio of operating income to total asset.

Tangibility: Tangibility represents a firm’s investment in fixed asset as a component of total asset. Tangible assets are broadly accepted determinants of capital structure because fixed assets provide security to the capital provider by directing a claim against capital erosion. Information asymmetry between borrowers and firms increases the agency cost of debt which can be reduced by using adequate tangible assets that may serve as collateral to issue debt (Jensen & Meckling, 1976). We calculate tangibility as total fixed asset divided by total asset following previous studies (Rajan & Zingales, 1995; Jamal et al., 2011; Teker et al., 2009; and Lima, 2009).

Debt Coverage: The debt coverage is usually measured by the ratio of operating income to interest expense and it shows the ability of a firm to make interest payment from its yearly operating income. Therefore, debt coverage ability of a firm could be positively related with leverage. Hence, higher debt level increases bankruptcy cost and eventually the possibility of bankruptcy (Baral, 2004). Agency theory suggests that a firm can reduce agency cost by using more debt than equity. Moreover, static trade-off theory suggests that optimal debt level is attained when present value of tax shield benefit completely offsets bankruptcy related cost of debt.

Growth Rate: Growth rate of a firm can be calculated as compounded growth rate of assets for the previous five years (Lima, 2009). Chen (2004) argued that firm’s having growth opportunities invest in risky investment to generate above average return for shareholders which enhances the controllable resources of the managers; thus there will be a divergence of wealth from debt holders to shareholders. Therefore, the relationship between growth opportunity and leverage is expected to be negative. The negative relationship between leverage and growth is also supported by Jensen & Meckling (1976); Barclay et al. (1995).

Firm Size: Firm size as an independent variable is calculated as natural log of total assets because only percentage change in the assets makes sense and previous studies also measured it in similar approach (Alom, 2013; Kouki and Said, 2012). Although size is a significant determinant of capital structure but the impact of size in determining leverage is mixed. Large firms can reduce financial distress cost by expanding their business horizon (Sayeed, 2011). Moreover, if any firm’s financial distress cost is lower, then the firm may be able deploy more debt to achieve more tax shield benefit of debt. Thus, size should be positively related with leverage. Static trade-off theory also envisages a positive relationship between size and leverage because this theory assumes that bigger size firm may be able to use more debt by reducing financial distress cost and increasing tax shield benefit.

Inflation Rate: In the inflationary period, the real value of bond goes down because higher interest rate is associated with inflation that reduces the price of bond and thus inflation is supposed to benefit borrower at the expense of lender (Myers, 1984). As inflation affects severely to the bondholders compared to the shareholders, so it is generally expected that bondholder will divert their investments from bond to stock in an inflationary period. Some researchers found that inflation is an insignificant determinant of capital structure (Mutenhei & Green, 2002; Gurcharan, 2010). However, as inflation reduces the real value of debt so we expect a negative relationship between inflation and leverage.

Interest Rate: Interest rate represents the cost of fund that borrower must need to pay for using fund for a particular period of time. It also reflects return for compensating risk that a lender assumes and hence, interest rate is critical because an increase in interest rate decreases volume of investment and a decrease in interest rate may increase the volume of investment (Singh, 1993). Static trade-off theory posits that a firm should balance marginal benefit of debt with marginal cost of debt. When interest rate increases, marginal cost of fund also increases that reduces profitability. Consequently, tax shield benefit of debt also decreases with reduced profit. So, we expect an inverse relationship between interest rate and leverage.

GDP Growth Rate: GDP growth rate is generally considered as a critical determinant of capital structure. Booth et al. (2001) studied capital structure determinants of developing countries and found a positive relationship between GDP growth rate and debt ratio. Bas et al. (2009) argued that growth rate of an economy represents available growth opportunities for the firms. So, it is expected that growth rate is positively related with leverage. POT also asserts that, growth opportunities of a firm should be capitalized by taking debt because internal fund may not be sufficient to finance growth. Thus, POT theory also suggests a positive relationship between GDP growth rate and leverage.

Stock Market Development: Stock market development can be calculated as the ratio of stock market capitalization to GDP (Kayo & Kimura, 2010). It is considered as one of the critical determinants of leverage because firm will issue equity instead of debt in bullish stock market as investors are wealthy enough to supply available fund required by the firm and thus obtain cheaper source of capital. Market timing theory suggests that firm time their securities issuance according to market conditions. So, when stock market outperforms debt market, firms may issue stock and when bond market outperforms stock market, firms may issue bond as a cheaper source of funding. Thus, it is expected that stock market development may be negatively related with leverage.

VARIABLES MEASUREMENT

The dependent variable of our analysis is leverage as capital structure decision involves determining the proportion of financial leverage. However, in case of independent variables six are firm-specific and four are macroeconomic variables. Table 1 shows independent variables construction for the level of debt, detailing the name and the description of the variables at the levels of firm and their expected signs.

|

Variables |

Definition |

Expected Sign |

| Liquidity (LQD) | Current Assets/ Current Liabilities | – |

| Profitability (PROFIT) | Operating Income/ Total Asset | – |

| Tangibility (TANG) | Total Fixed Asset/ Total Asset | + |

| Debt Coverage (DÉCOR) | EBIT/ Interest Charges | + |

| Growth Rate (GR) | Total Assett / Total Asset t-1 | + |

| Farm Size (FSIZE) | Log of Total Asset | + |

| GDP Growth (GDPG) | Real GDP Growth Based on Constant Prices | + |

| Inflation (IBF) | Annual Change in Consumer Price Index | – |

| Interest Rate (INR) | 365 Day Treasury Bill Rate | – |

| Stock MKT Development (SMDEV) | Stock Market Capitalization/Annual GDP | – |

METHODOLOGY

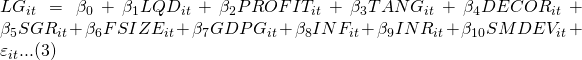

The simplest way to handle panel data is to estimate the parameters using OLS, in which data on individual entity are pooled together ignoring the individual differences that can lead to different coefficients (Adkins & Hill, 2007, p.240). In our present context, a pooled model in which leverage is regressed on a set of potential determinants of target capital structure is specified as follows:

![]()

![]()

Where, LGit = the measure of leverage of a firm i at time t, β0 = the intercept of the equation and is the composite error term. In the pooled model, are assumed constants across firms and over time, and, hence, cannot capture individual heterogeneity. This type of treatment of panel data can give us estimates with desirable properties if, , the error term, has zero mean and constant variance, uncorrelated with the regressors, and the regressors are nonrandom (Adkins & Hill, 2007). In the presence of individual heterogeneity, the OLS, however, fails to provide us estimates with desirable statistical properties, which calls forth advanced treatment of data set. Given this backdrop, more advanced modeling like fixed and random effects models can give much better results.

Fixed Effects (FE) Estimators: To understand the fixed effect regression model for our current problem, we started with the following panel regression model:

![]()

Since βi varies from one firm to the next, but do not vary over time, this regression model has virtually n intercepts, one for each firm. It may be noted that βi has two components: a constant component, and an error component capturing the individual differences. In essence, the fixed effects model estimates parameters using data in deviation form (Stock & Watson, 2003, p. 156). By doing so, the fixed effect estimators can get around the problem of entity specific heterogeneity.

Random Effects Estimators: To the contrary of the fixed effects model, the random effects model further assumes that the error term arising from individual differences are identically and independently distributed of the repressors considered in the model (Greene, 2010). With these assumptions, the error component of the individual differences becomes inseparable from the usual idiosyncratic error term, and hence, we come up with a common intercept for the whole model.

Specifically, the random effect model can be specified for the underlying problem as follows:

Where, εit is the composite error term under the assumption of strict heterogeneity. The problem of OLS estimation approach to this type of model is that the composite error term can get serially correlated. To circumvent the problem of serial correlation, the Feasible Generalized Least Square (FGLS) approach can be good alternative. To see the casualty among the variables we also conducted bivariate regressions in a panel context. The general form of the bivariate regressions in a panel data context can be specified as follows:

![]()

![]()

Where t denotes the time period dimension of the panel, and i denotes the cross-sectional dimension. The above model assumes that all coefficients are same across all cross-sections, i.e.:

![]()

![]()

RESULTS AND DISCUSSIONS

Table 2 presents descriptive statistics of the variables used in the study. Summary statistics include the mean, the standard deviation, maximum, and minimum of the variables over the period covering 2008-2012. Average debt ratio of the chosen firms is 0.485 which indicates that firm use 48.5% leverage in their capital structure. Average liquidity ratio is 1.43 that indicates that firms are capable of paying short term obligation smoothly. Average profitability is 12% and debt coverage ratio is 17.78. Stock market development is 0.55 and it is expected to be negatively related to leverage as because firm might issue equity in developed stock market due to its lower issuance cost over leverage.

| Variables | Mean | Std. Deviation | Minimum | Maximum |

| Debt | 0.48 | 0.23 | 0.08 | 1.09 |

| Liquidity | 1.43 | 0.69 | 0.30 | 5.00 |

| Profitability | 0.12 | 0.09 | -0.09 | 0.77 |

| Tangibility | 0.50 | 0.24 | 0.06 | 0.94 |

| Debt Coverage | 17.78 | 79.96 | -3.43 | 653.17 |

| Growth Rate | 0.21 | 0.49 | -0.31 | 4.66 |

| Size | 9.08 | 0.86 | 6.13 | 10.44 |

| GDP Growth | 0.06 | 0.002 | 0.06 | 0.06 |

| Inflation | 0.08 | 0.02 | 0.05 | 0.11 |

| Interest Rate | 0.07 | 0.03 | 0.04 | 0.11 |

| Stock MKT Development | 0.55 | 0.19 | 0.31 | 0.91 |

Moreover, other macroeconomic variables such as real GDP growth rate, annual inflation, and annual interest rate are 6.0%, 8.0% and 7.45% respectively. It may be noted that GDP growth rate, inflation, and interest rate showed lowest deviation among all variables considered and thereby suggesting their consistency over time.

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | VIF |

| 1. Dratio | 1 | -0.46** | -0.14 | -0.39* | -0.09 | 0.16 | -0.16 | -0.08 | -.004 | -0.11 | -0.12 | |

| 2. LQD | -0.46** | 1 | 0.27** | -0.34** | 0.29** | -0.08 | 0.12 | 0.02 | -0.03 | 0.07 | 0.04 | 1.49 |

| 3. PROFIT | -0.14 | -0.27** | 1 | -0.28** | 0.25** | -0.028 | 0.06 | 0.09 | 0.03 | -0.15 | 0.12 | 1.24 |

| 4. TANG | -0.39** | -0.34** | -0.28** | 1 | -0.25** | 0..14 | 0.18* | 0.02 | -0.02 | 0.00 | 0.05 | 1.27 |

| 5.DECOVER | -0.09 | -0.29** | -0.24** | -0.25** | 1 | -0.02 | -0.48** | 0.05 | -0.04 | -0.11 | 0.12 | 1.74 |

| 6.SGR | -0.19* | -.08 | -0.03 | 0.15 | 0.02 | 1 | 0.06* | 0.19* | 0.13 | -0.05 | 0.18 | 1.09 |

| 7.FSIZE | -0.16 | 0.12 | 0.06 | 0.18* | -0.48* | 0.05 | 1 | -0.01 | 0.01 | 0.12 | -0.01 | 1.66 |

| 8.GDPG | -0.08 | 0.02 | 0.09 | 0.01 | 0.05 | 0.18* | -0.01 | 1 | 0.56** | 0.27** | 0.80** | 9.96 |

| 9.INF | -0.004 | -.03 | 0.02 | -0.01 | -0.04 | 0.13 | 0.01 | 0.56** | 1 | 0.19* | 0.10 | 3.04 |

| 10. INR | -0.11 | -0.07 | -0.14 | O.00 | -0.11 | -0.05 | -0.12 | 0.28** | 0.19* | 1 | 0.06 | 1.39 |

| 11.SMDEV | -0.12 | 0.04 | 0.12 | 0.04 | -0.12 | 0.17 | -0.01 | 0.80** | 0.10 | 0.06 | 1 | 6.62 |

Note: *, ** Denote significance at 10% and 5% level respectively

According to the correlation matrix in Table 3, it is obvious that there is a relatively high correlation among some of the variables like stock market development and GDP growth rate; debt coverage and firm size. Investigating the variance inflation factor (VIF) reveals no multicollinearity and all individual values are well below critical value of 10 (below the conventional threshold of 10, McDonald & Moffit, 1980; Chatterjee & Price, 1991). Thus, we may conclude that multicollinearity does not appear to be a big problem in our estimates.

There is need for selecting appropriate estimator before proceeding to the estimation and thereby the present study expansively tried to specify appropriate model to be estimated, upon conducting a series of diagnostic checks. Greene (1997) pointed out that panel data would typically exhibit serial correlation, cross-sectional correlation, and group-wise heteroscedasticity. Breuch and Pagan (1980) developed a test for random effects and Baltagi & Li (2001) and Bera et al. (2001) devised Lagrange Multiplier (LM) tests for model specification as well as for detecting the presence of autocorrelation. Pesaran (2004) developed a test for cross-sectional dependence (CSD) that may arise due to the presence of three factors: the presence of common shocks and unobserved components that may become the part of the error term; spatial dependence, and idiosyncratic pair-wise dependence in the error term. The results of various diagnostic tests are presented at the bottom panel of Table 4.

| Variables | Fixed Effects (PCSE) | Paris-Winsten RE (PCSE) |

| LQD | -0.1033*** (0.0170) | -0.1445***(0.0197) |

| PROFIT | -0.0534*(0.0294) | -0.2606***(0.0642) |

| TANG | -0.6565***(0.0699) | -0.6370***(0.0680) |

| DECOVER | -0.00002 (0.00002) | -0.00004(0.00007) |

| SGR | -0.0246***(0.0063) | -0.0502*** (0.0178) |

| FSIZE | -0.0920(0.0603) | 0.0061 (0.0168) |

| GDPG | 6.3941***(1.9278) | 9.0592***(3.7389) |

| INF | -0.4015**(0.1701) | -0.5415***(0.2580) |

| INR | -0.4705*(0.2382) | -0.8393***(0.2183) |

| SMDEV | -0.1246***(0.0292) | -0.1499***(0.0388) |

| Constant | 1.5628***(0.6246) | 0.6328** (0.2861) |

| R2 | 0.5130 | 0.6456 |

| Wald | 1354.24*** | |

| F | 81.54*** | |

|

Diagnostic Checks |

||

|

Cross Sectional independence |

305.452*** | |

| Hausman Test | 33.84*** | |

| Robust Hausman Test | 46.335*** | |

| Heteroscedasticity | 7310.39*** | |

| Serial Correlation | 17.231*** | |

| Chow Test for individual effects | (F = 17.59***) | |

Based on the test results presented in Table 4, we rejected the null hypothesis of homoscedasticity across the panels and we conclude that first-order autocorrelation is present in the dataset. Cross-sectional dependence is tested with a Breusch-Pagan LM test and based on the results we have rejected the null hypothesis of no cross-sectional dependence. The presence of cross-sectional dependence in the dataset implies that Prias-Winsten regression which addresses the problem of heterskedasticity, AR(1) as well as provides panel-corrected standard errors (PCSE) seem to be more appropriate model to be dealt with specifically when the sample size is not substantially large enough. As the panel dataset have exhibited serial correlation, cross-sectional correlation, and group-wise heteroscedasticity therefore we comprehensively tried to find the most relevant estimator for the present study.

To choose between fixed and random effects models, the study applied Hausman test and robust Hausman test, which corrects heteroscedasticity and based on these two tests it is found that fixed effects estimators are suitable for estimation. Table 4 therefore presents the fixed effect model that addresses all the panel data problems. For comparison purpose we also present the results of Prais-Winsten random effects model (PCSE). The findings of the study using fixed effect model as the appropriate model for this study suggests that liquidity has significant negative impact on leverage under fixed effect model. This negative relation is consistent with POT which states that firm should prefer internal financing as a first priority. Liquid assets are supposed to be converted in cash in short term that could be used as internal financing source. The negative association between leverage and liquidity indicates that firms with strong growth opportunities and firms with small size may hold more cash than the other firms. Several previous studies also reported significant negative relationship between liquidity and leverage (Deesomsak et al., 2004; Shahjahanpour et al., 2010; Jamal et al., 2013). Profitability has significant negative impact on leverage and the negative relationship between leverage and profitability is also consistent with POT because profitable firm is capable of raising more internal fund than their peers with less profitability. However, this negative relationship between profitability and leverage is inconsistent with static-trade off theory because this theory assumes that profitable firm should deploy more debt in capital structure to shield their profit from taxes. Our results are in conformity with the results of Afza & Hussain (2011).

Tangibility has significant negative impact on leverage under fixed effect model. The result suggests that if firm deploys more fixed asset then they may use less debt. Moreover, the negative relationship between tangibility and leverage is justified under POT that supports internal fund preference over external fund. Booth et al. (2001); Al-Ajmi et al. (2009) also found an inverse relationship between tangibility and leverage. In contrary, Frank & Goyal (2004) and Rajan & Zingales (1995) found a positive relationship between tangibility and leverage. The positive relationship between tangibility and leverage can be attributed to the fact that tangible asset can be used as collateral to issue debt. As because collateralized debt is less costly than uncollateralized debt, thus tangibility can be positively related with leverage. Debt coverage is negatively related under fixed effect model. The negative relationship between debt coverage and leverage is consistent with POT. Based on the estimated results it may be deduced that higher positive operating earnings are expected to generate higher amount of internal cash flows that can be used for financing investment. But negative relationship between debt coverage and leverage is inconsistent with static trade-off theory as this theory suggests higher operating earning can be shielded from tax by using more leverage. Bhat (1980) found an inverse relationship between debt coverage and leverage. In contrary, Lima (2009) also found a positive but significant relationship between debt coverage and leverage.

Growth rate is significantly and positively related with leverage and this result is consistent with Lima (2009) who found a significant positive relationship between growth and leverage. According to agency theory, growth firm faces conflict of interest between debtor and creditor because these firms tend to deploy fund in risky projects to capitalize their growth which benefit shareholders at the expense of bondholders (Myers, 1977). In contrary, POT proposes a positive relationship between growth and leverage because internally generated fund may be insufficient to finance growth opportunities. However, Chowdhury (2004), Barclay et al. (1995), Rajan and Zingales (1995) found an inverse relationship between growth and leverage. Firm size has negative impact on leverage and based on the results we may claim that bigger size firms may generate greater internal cash flows that may be used for financing investment. Thus, negative relationship between firm size and leverage is supported under POT. Titman & Wessels (1988) found an inverse relationship between firm size and leverage. As large firms’ asset base is greater, their financial distress cost is also lower. So, they can use more debt to get the advantage of greater tax shield benefit. Thus, bigger size firm is expected to deploy more debt than smaller size firm in their capital structure.

GDP growth has a significant positive impact on leverage. The significant linear relationship between GDP growth and leverage can be attributed to the fact that GDP growth measures the overall economic performance which incorporates investment return of firms that is affected by corporate gearing. Hence, in the period of economic growth firms tend to deploy more debt as business is emerged with new growth opportunities. Several studies also documented a positive relationship between long-term debt and GDP growth (Mateus, 2006; Salehi & Manesh, 2012). Inflation has a negative impact on leverage and it is expected that inflation be negatively related with leverage as inflation reduces the real value of a bond and forces investors to shift their investment from bond to stock. Moreover, as inflation increases uncertainty also increases the riskiness of bondholders which eventually increases the effective cost of issuing debt. Thus, inflation can have negative impact on leverage. Dokko (1989) demonstrated that inflation transfers wealth from bondholder to stockholder. Booth et al. (2001) showed empirical evidence that inflation reduces both total and long term debt ratio in developing countries. Interest rate has significant negative impact on leverage and this finding suggests that interest rate may be negatively related with debt as it represents the cost of debt and when cost of debt is higher firm should borrow less, holding other things constant. This inverse relationship is in line with market timing theory that suggests that interest rate and leverage are negatively related with leverage. Antoniou et al. (2002) and Dincergok & Yalciner (2011) also found a negative relationship between interest rate and leverage. Stock market development has significant negative impact on leverage and according to market timing theory, firm may issue equity only when equity market is performing well. So, in a better performing equity market equity issuance has preference over debt because of its lower cost. Thus, leverage may be negatively related with stock market development. Our finding is in line with the findings of previous studies (Kayo & Kimura, 2011; Demirgüç & Maksimovic, 1996). Table 5 shows the results of ‘pairwise’ Granger causality test with 2 lags between the dependent variable and independent variables . We see that there exists a unidirectional causality from ‘Debt ratio’ to ‘Liquidity’ and ‘Size’ to ‘Debt ratio’. No cause-effect relationship has been found among other variables in the table.

The results of unidirectional causality from ‘Debt ratio’ to ‘Liquidity’ and ‘Size’ to ‘Debt ratio’ lend support to pecking order hypothesis (POT) which states that firm should prefer internal financing as a first priority while determining the optimal capital structure.

CONCLUSION

The present study attempted to lay some groundwork to explore the determinants of capital structure of pharmaceutical firms listed on the Dhaka Stock Exchange (DSEX) over the period 2008 – 2012. In this study, both the firm-specific and macroeconomic determinants of the capital structure were examined. The study applied a number of advanced econometric techniques, e.g. error component model estimation, fixed effect model, and PCSE to identify the determinants of capital structure. Among different variants of error component models, fixed effects and random effects were applied upon necessary diagnostic tests. The effects of ten explanatory variables are measured on leverage ratio which is calculated by dividing the total debt by total assets. The empirical evidence indicated that independent variables of the study- profitability, liquidity, and growth opportunities in total assets, inflation, interest rates and stock market developments–seem to play pivotal role in determining the capital structure decisions of selected Bangladeshi pharmaceutical firms. More specifically, we find that both firm specific and macroeconomic conditions affect on firms’ capital structure.

To summarize, the evidence we develop supports the hypothesis that both trade-off and pecking order theories can explain financing decisions of listed pharmaceutical firms in Bangladesh. Taking into consideration the positive economic developments in Bangladesh firms may adjust their debt-equity position to achieve their desired leverage level as the strength and the nature of both the firm specific and macroeconomic factors may change over time. Future research might address the sensitivities of determinants of capital structure by distinguishing firms as highly levered and less levered. Since the determinants of capital structure may vary from one industry to another industry hence the firm specific as well macroeconomic influence on capital structure on other industries may be explored in further study.

References

- Adkins, L.C. & Hill, R.C. (2007), Using Stata for Principles of Econometrics. 4th Edition. John Wiley & Sons, Inc. New York, NY.

- Afza, T & Hussain, A. (2011), “Determinants of Capital Structure: A case study of automobile sector of Pakistan, Interdisciplinary Journal of Contemporary Research in Business, Vol.2, No.10, pp. 219-230.

- Alom, K. (2013), “Capital structure choice of Bangladeshi firms: an empirical investigation”, Asian Journal of Finance & Accounting, Vol.5, No. 1, pp. 320-333.

- Al- Ajmi, J., Hussain, H.A, & Al-Saleh, N. (2009), “Decisions on capital structure in a Zakat environment with prohibition of riba: The case of Saudi Arabia”, The Journal of Risk Finance. Vol 10, No. 5, pp. 460-476.

- Antoniou, A., Guney, Y. & Paudyal, K. (2002), Determinants of corporate capital structure: Evidence from European countries. University of Durham, working paper.

- Baker, M. & Wurgler, J. (2002), “Market Timing and Capital Structure”, the Journal of Finance, Vol. 57. No. 1, pp. 1-32.

- Baltagi, B. H., & Li, D. (2001), “LM tests for functional form and spatial error correlation”, International Regional Science Review, 24(2), pp.194-225.

- Barclay, M. J., & Smith, C. W. (1995), “The maturity structure of corporate debt. The Journal of Finance, Vol. 50 No. 2, pp. 609-631.

- Bera, A. K., Sosa-Escudero, W., Yoon, M. (2001), “Test for the error component model in the presence of local Misspecification”, Journal of Econometrics, Vol.101, No 1, pp.1-23.

- Bevan, A. A., & Danbolt, J. (2002), “Capital structure and its determinants in the UK-a decompositional analysis’, Applied Financial Economics, Vol.12, No.3, pp.159-170.

- Baral, K. J. (2004), “Determinants of capital structure: A case study of listed companies of Nepal”, Journal of Nepalese Business Studies, Vol.1, No. 1, pp.1-13.

- Bas, T., Muradoglu, G., & Phylaktis, K. (2009), “Determinants of Capital Structure in Developing Countries”, Working Paper Series.

- Bhat, R. K. (1980), “Determinants of Financial Leverage: Some Further Evidence”, Chartered Accountant, Vol. 29, pp.451-456.

- Booth, L. V., Aivazian, A. Demirguc-kunt & Maksimovic, V. (2001), “Capital structures in developing countries. Journal of Finance, Vol.56, No.1, pp.87–130.

- Breusch, T. S., & Pagan, A. R. (1980), “The Lagrange multiplier test and its applications to model specification in Econometrics”, The Review of Economic Studies, Vol. 47, No.1, pp.239-253.

- Chowdhury, D. (2004), “Capital structure determinants: Evidence from Japan & Bangladesh”, Journal of Business Studies, Vol. 30, No. 11, pp.23-45.

- Chatterjee, S. & Price, B. (1991), Regression Analysis by Example. John Wiley & Sons, New York, NY.

- Çekrezi, A. (2013), “Impact of firm specific factors on capital structure decision: An empirical study of Albanian Firms”, European Journal of Sustainable Development, Vol. 2, No. 4, pp.135-148.

- Chkir, I. E., & Cosset, J. C. (2001), “Diversification strategy and capital structure of multinational corporations”, Journal of Multinational Financial Management, Vol. 11, No. 1, 17-37.

- Chen, J. J. (2004), “Determinants of capital structure of Chinese-listed companies”, Journal of Business research, Vol. 57, No. 12, pp.1341-1351.

- Deesomsak, R., Paudyal, K. & Pescetto, G. (2004), “The determinants of capital structure: evidence from the Asia Pacific region”, Journal of Multinational Financial Management. Vol.14, No. 4-5, pp.387-405.

- Demirgüç-Kunt, A., Maksimovic, V. (1996), “Stock market development and financing choices of firms”, The World Bank Economic Review, Vol. 10, No2, pp.341–369.

- Dincergok, B. & Yalciner, K. (2011), “Capital structure decisions of manufacturing firms’ in developing countries”, Middle Eastern Finance and Economics, Vol. 12, pp.86-100.

- Dokko, Y. (1989), “Are change in inflation expectations capitalized into stock prices? A micro firm test for the nominal contracting hypothesis”, The Review of Economics and Statistics, Vol.71, pp.309-317.

- Frank, M. Z. & Goyal, V. K. (2009), “Capital Structure Decisions: Which Factors are Reliably Important”? Financial Management, Vol. 38. No.1, pp.1-37.

- Frank, M. & Goyal, V. (2004), “Capital structure decisions: which factors are reliably important”? Working paper, Sauder School of Business, University of British Columbia, Canada.

- Gaud, P., Jani, E., Hoesli, M. & Bender, A. (2005), “The capital structure of Swiss companies: An empirical analysis using dynamic panel data”, European Financial Management, Vol.11. No. (1), pp.51-69.

- Greene W. H. (1997), Econometric Analysis, New York, Prentice Hall.

- Greene W. H. (2010), Econometric Analysis, New York, Prentice Hall.

- Gulati, D., & Zantout, Z. (1997), “Inflation, capital structure, and immunization of the firm’s growth potential”, Journal of Financial and Strategic Decisions, Vol. 10, No.1, pp. 77-90.

- Gurcharan, S. (2010), “A review of optimal capital structure determinant of selected ASEAN countries”, International Research Journal of Finance and Economics, Vol. 47, pp.30-41.

- Harris, M. & Raviv, A. (1991), “The theory of capital structure”, The Journal of finance, Vol. 46, No. 1, pp.297-355.

- Hovakimian, A. & Li, G. (2011), “In Search of Conclusive Evidence: How to Tests for Adjustment to Target Capital Structure”, Journal of Corporate Finance, Vol. 17, No.1, pp.33-44.

- Hussain, I. (2011), “Growth and financing behavior of firms of textile industry in Pakistan: A panel data analysis”, The Pakistan Development Review, pp.699-714.

- Jamal, A. A. A., Geetha, C., Mohidin, R., Karim, M. R. A., Sang, L. T., & Ch’ng, Y. (2013), “Capital Structure

- Decisions: Evidence from Large Capitalized Companies in Malaysia”, Interdisciplinary Journal of Contemporary Research in Business, Vol. 5 No. 5, pp.30-49.

- Jensen, M. C. (1986), Agency cost of free cash flow, corporate finance, and takeovers. Corporate Finance and Takeovers. American Economic Review, Vol. 76, No.2, pp.323-329.

- Jensen, M. C., & Meckling, W. H. (1976), “Theory of the firm: Managerial behavior, agency costs and ownership Structure”, Journal of financial economics, Vol. 3 No. (4), pp. 305-360.

- Jõeveer, K. (2006), Sources of capital structure: Evidence from transition countries, CERGE-EI Working Paper, 306.

- Kayo, E.K. & Kimura, H. (2011), “Hierarchical determinants of capital structure”, Journal of Banking & Finance, Vol. 35, No 2, pp. 358-371.

- Kiran, S. (2013), “Determinants of Capital Structure: A Comparative Analysis of Textile, Chemical & Fuel and

- Energy Sectors of Pakistan”, International Review of Management and Business Research, Vol. 2, No. 1, pp. 37-47.

- Kouki, M. & Said, H. B. (2012), “Capital structure determinants: new evidence from French panel data”, International Journal of Business and Management, Vol. 7, No. 1, pp. 214-229.

- Lemmon, M. L., Roberts, M. R. & Zender, J. F. (2008), “Back to the Beginning: Persistence and the Cross-Section of corporate capital structure, Journal of Finance, Vol. 63, No. 4, pp.1575-1608.

- Lima M. (2009), “An Insight into the Capital Structure Determinants of the Pharmaceutical Companies in Bangladesh”. http://www.gbmf.info/2009/An_insight_into_the_ Capital_Structure_Determinants_Lima.pdf.

- McDonald, J.F. & Moffit, R.A. (1980), “The uses of Tobit analysis”, Review of Economics and Statistics, Vol. 62, No 2, pp. 318–321.

- Miller, M. H. (1977), “Debt and Taxes”, Journal of Finance, Vol.32, pp. 261-275.

- Modigliani, F. & Miller, M.H. (1958), “The Cost of Capital, Corporation Finance and the Theory of Investment”, American Economic Review, Vol.48, pp. 261-297.

- Mutenheri, E., & Green, C.J. (2002), “Financial return and financing decisions of listed firms in Zimbabwe”, Economic Research Paper, No.0215. Department of Economics, Loughborough University.

- Muthama, C., Mbaluka, P. & Kalunda, E. (2013), “An empirical analysis of macro-economic influences on corporate capital structure of listed companies in Kenya”, Journal of Finance and Investment Analysis, Vol. 2, No. 2, pp. 41-62.

- Myers, S.C. (1977), “Determinants of corporate borrowing”, Journal of Financial Economics, No. 5, pp.147-175.

- Myers, S.C. (1984), “The capital structure puzzle”, Journal of Finance, Vol. 39, No. 3, pp.575-592.

- Myers, S. C. & Majluf, N.S. (1984), Corporate financing and investment decisions when firms have information that investors do not have”, Journal of Financial Economics, Vol.13, No.2, pp.187-221.

- Jensen, M. & Meckling, W. (1976), “Theory of the firm: Managerial behavior, agency costs, and ownership structure”, Journal of Financial Economics, Vol. 3, pp. 305-360.

- Pesaran, M. H. H. M. (2004), “General diagnostic tests for cross section dependence in panels”, Discussion Paper No.1240.

- Rajan, R. & Zingales, L. (1995), “What do we know about capital structure? Some evidence from international data”, Journal of Finance, Vol. 50, pp. 1421- 1460.

- Ross, S. A. (1977), “The determination of financial structure: the incentive signaling approach”, Bell Journal of Economics, Vol. 8, pp. 23-40.

- Salehi, M. & Manesh, N.B. (2012), “A study of the roles of firm and country on specific determinates in capital structure: Iranian evidence”, International Management Review, Vol. 8, No. 2, pp.51-62.

- Sayilgan, H. and Küçükkocaoğlu. (2006), “The firm-specific determinants of corporate capital structure: evidence from Turkish panel data”, Investment Management and Financial Innovations, Vol. 3, No. 3, pp.125-139.

- Sayeed, M. A. (2011), “The determinants of capital structure for selected Bangladeshi listed companies”, International Review of Business Research Papers, Vol. 7, No. 2, pp.21-36.

- Singh, A. (1997), “Financial liberalization, stock markets and economic development”, The Economic Journal, Vol. 107, No. 442, pp.771-782.

- Shah, A. & Khan, S. (2007), “Determinants of capital structure: evidence from Pakistani panel data”, International Review of Business Research Papers, Vol.3, No.4, pp.265-282.

- Smith, C. & Watts, R. (1992), “The investment opportunity set and corporate financing, dividend and compensation Policies’, Journal of Financial Economics, Vol. 32, pp.263-292.

- Shahjahanpour, H. Ghalambor & Aflatooni, A. (2010), “The determinants of capital structure choice in the Iranian Companies”, International Research Journal of Finance and Economics, Vol. 56, pp.167-178.

- Stock, J. & Watson, M.W. (2003). Introduction to econometrics, Third Edition. New York, Prentice Hall.

- Stephan, A. & Talavera, O. (2004). Macroeconomic Uncertainty and Firm Leverage, European University Viadrina, DIW Berlin. Working Paper.

- Titman, S. & Wessels, R. (1988), “The determinants of capital structure choice”, Journal of Finance, Vol. 43, No. 1, pp.1-19.

- Teker, D., Tasseven, O., & Tukel, A. (2009), “Determinants of capital structure for Turkish firms: a panel data Analysis”, International Research Journal of finance and Economics, Vol.29, pp.179-187.

- Yeh, H. H., & Roca, E. (2010), “Macroeconomic conditions and capital structure: Evidence from Taiwan”, Griffith Business School, Discussion papers: Finance, (2010-14)

© The Author 2016. Published by Business Review – A Journal of Business Administration Discipline, Khulna University, Khulna, Bangladesh.

Keywords