Liquidity Risk and Performance: A Study on the Banking Sector of Bangladesh

Md. Reaz Uddin

Business Administration Discipline, Khulna University, Khulna, BD

Syed M. Ali Reza

Department of Management Studies, University of Rajshahi

Alok Kumar Sana

Business Administration Discipline, Khulna University

Khulna University Business Review – A Journal of Business Administration Discipline, Khulna University, BD

Volume 11, Number 1 & 2, January to December 2016, Pages 35-42

DOI: 10.35649/KUBR.2016.11.12.3

Published: May 2018

Published Online: July 2019

Abstract

Purpose: The aim of the study is to find out relationship between liquidity risk and bank performance. This study has been conducted based on secondary data collected from the annual reports of selected banks.

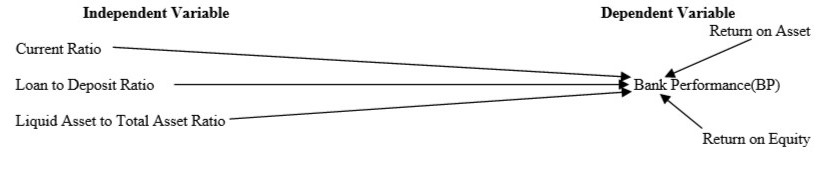

Design: This is a causal study where dependent variable is bank performance (BP) which is the combination of two factors namely return on assets (ROA) and return on equity (ROE). Independent variables are current ratio (CR), loan to deposit ratio (LDR) and liquid asset to total asset ratio (LATAR). The study has been conducted on secondary data that has been collected from the annual reports of the banks. Multiple regression analysis has been applied to actualize research objectives.

Findings: The study shows that there is no significant relationship between current ratio and bank performance, on the other hand effect of loan to deposit ratio and liquid asset to total asset ratio have statistically significant relations with bank performance. The study identifies negative relationship between bank performance and loan to deposit ratio; bank performance and liquid asset to total asset ratio.

INTRODUCTION

Banking sector is the backbone of financial system of an economy. It is an integral part of the financial sector and strength of the banking system brings stability and growth in financial health of a country (Arif and Anees, 2012). In Bangladesh, the financial system is dominated by banking sector rather than capital market. Banking system is comprised of state oriented commercial banks (SCBs), specialized banks (SBs), local private commercial banks (PCBs) and foreign commercial banks (FCBs) (Abdullah and Jahan, 2014). Performance of banks has significant impact on the economy of Bangladesh. Banks contributes in the growth of new businesses, generating employment opportunities and enabling the development of agriculture, industry and service sector of the country (Khan and Syed, 2013). This sector is playing important role but it is not free from various types of risks in particularly liquidity risk that always is challenging for proper management of banking operations. An efficient banking system ensures generation and mobilization of savings. As banks take deposit and give loan simultaneously, it has been a tremendous challenge for banks to make profit maintaining adequate level of liquidity (Diamond and Rajan, 2005). The diverse nature of the functions of banks, expose them to liquidity risk (Khan and Syed, 2013). Liquidity risk is one of the major barriers in ensuring this free flow (Abdullah and Jahan, 2014). Liquidity risk is the potential for loss to an organization, arising from either its incapability to encounter its responsibilities or to fund upsurges in assets as they drop due deprived of incurring unacceptable losses or cost (Khan and Syed, 2013).

Since banking sector of Bangladesh is the major player of the financial system of the country and it has significant impact on the economic development of the country, performance of the banking sector of the country is an important area to study. Different scholars studied on banking performance in terms of liquidity risk of the sector. This study has overviewed performance of the banking sector of Bangladesh in terms of liquidity risk and tried to find out the relationship between banks’ liquidity risk and profitability. Financial system of Bangladesh is mainly bank oriented. Banking sector of the country is comprised of both state oriented and private commercial banks (Bangladesh Bank, 2015). Managing liquidity risk, in Bangladesh, is not less challenging for the banks than those of other countries. A change in the level of liquidity risk for the banks here has significance in the financial performance of the banks. Therefore, a well-designed study is needed to point out relationship of liquidity risk and performance of banks which carries significant values for the overall banking sector of this country. A number of studies have been conducted on liquidity risk. However, most of the works focus on the techniques and strategies of managing liquidity risk problems (Decker, 2010; Holmstrom, & Tirole, 2010; Kroszner, 2008). Some researchers have aimed at finding relationship between liquidity risk and their impacts on the financial performance of the banking sectors of a country (Alzorqan, 2014; Azureen, 2015; Arif & Anees , 2012). Toutou and Xiaodong (2011) studied the relationship between liquidity risk and performance for European banks. Rahman and Saeed (2015) examined such relationship from the perspective of Malaysian banking system. Arif and Anees (2012) had conducted study on liquidity risk- bank performance relationship on the banking system of Pakistan. Previous studies have conducted in perspective of various countries but they have not concluded with unanimous results. Apart from that, those studies were not conducted based on the banking sector of Bangladesh. Considering the situation, this study intends to presents how liquidity risks affect bank performance of Bangladesh. Thus the objective is to investigate relationship of liquidity risk and performance of banks.

THEORETICAL FRAMEWORK

Liquidity: Liquidity is simply convertibility of resources that basically indicates how quickly assets can be exchanged and cash is received. It is the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price (Investopedia, 2016). Market liquidity is the extent to which a market, for example country’s stock market, allows assets to be bought and sold at stable prices. Cash is the most liquid asset, on the other hand real estate, fine art and collectibles are all relatively illiquid (Investopedia, 2016). Accounting liquidity measures the ease with which an individual or company can meet their financial obligations with the liquid assets available to them. Kroszner (2008) defines liquidity as the ability to fund increase in marketable securities and meet obligations as they become due. Nikolaou (2006) refers liquidity as unhindered flows among the agents of the financial system, with a particular focus on the flows among the central bank, commercial banks and markets. The term ‘liquidity’ usually receives additional attention from bankers. Bank liquidity means the ability of the bank to meet financial obligations as those come due. Liquidity in commercial banks means the bank’s ability to finance all its contractual obligations when due, and these obligations can include lending, investment and withdrawal of deposits and maturity of liabilities, which happen in the normal course of banking activities (Amengor, 2010). Liquidity plays important roles in capturing opportunities originate from the broader environment of business. One needs ready cash to capitalize market opportunities. Besides, liquidity helps to safeguard against unforeseen happening or financial setback (Kroszner, 2008). Cash, savings account, checkable account are widely considered as liquid assets because these can be easily converted into cash. A bank’s holdings of liquid assets are important in helping a bank to withstand certain shocks (Nikolaou, 2006).

Liquidity Risk and Causes of Liquidity Risk: Business activities are encircled by various types of risks and the nature of banking and financial institutions activities are subject to more risk than others. The risks may be termed as credit risk, operational risk, interest rate risk, market risk and foreign exchange risk etc (Azureen et al., 2015). The Banque de France Financial Stability Report refers liquidity risk as the inability of a bank to manage its liquidity position in order to cover mismatch between future cash outflow and cash inflow. Basel Committee on Banking Supervision (2006) explained that liquidity risk arises from the inability of a bank to accommodate decreases in liabilities or to fund increases in assets. Besides (Decker, 2000) indicated that liquidity risk can be divided into funding liquidity risk and market liquidity risk. In their work on finding relationship between liquidity and banks’ profitability (Arif and Anees, 2012) pointed that the varied nature of banking business, such as receiving deposits and extending loans, facilitating payments and settlement systems, and supporting the transfer of goods and services exposed banks to a high liquidity risk. Opinion of (Tabari et al., 2013) supports the statement of (Arif and Anees, 2012). They said liquidity risk emerges from the inability of banks to accommodate decreases in liabilities or to fund increases in assets (Tabari et al., 2013). (Imbierowicz and Rauch, 2014) further added that liquidity risk may emerge not only from banks’ balance sheet business, but also from lending and funding business conducted through off-balance sheet items. Liquidity risk arises from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss. It further adds that liquidity risk occurs when an individual investor, business or financial institution cannot meet short-term debt obligations. The investor or entity may be unable to convert an asset into cash without giving up capital or income due to a lack of buyers or an inefficient market (Investopedia, 2016). (Saunders and Cornett, 2006) pointed out two reasons to identify the causes of liquidity risk. The reasons are liability-side reason and an asset-side reason. The liability-side reason occurs when a financial institution’s liability holders, for instance depositors or insurance policy holders, seek to cash in their financial claims immediately. As liability holders demand cash by withdrawing deposits, the financial institution needs to borrow additional funds or sell assets to meet the withdrawal (Saunders and Cornett, 2006). The second cause of liquidity risk is asset-side liquidity risk, such as the ability to fund the exercise of off-balance-sheet loan commitments. When a borrower draws on its loan commitment, bank must fund the loan on the balance sheet immediately and it creates a demand for liquidity. Bank can meet such a liquidity need by running down its cash assets, selling off other liquid assets, or borrowing additional funds (Saunders and Cornett, 2006).

Measurement of Liquidity Risk: (Saunders and Cornett, 2006) studied on the measurement of liquidity risk. In their book, the authors proposed several approaches on liquidity risk measurement including formation of net liquidity statement, peer group ratio comparisons, liquidity index, financing gap and the financing requirement (Shen et al., 2009). Bank managers need to measure liquidity position on a daily basis. Net liquidity statement is a useful tool on this purpose because it lists sources and uses of liquidity and thus provides a measure of a depository institution’s net liquidity position (Saunders and Cornett, 2006). Peer Group Ratio Comparisons compare some key ratios and balance sheet features of the depository institution. The ratios include loans to deposits, borrowed funds to total assets, and commitments to lend to assets ratios (Saunders and Cornett, 2006). Liquidity Index (LI) is another way to measure liquidity risk which is developed by Jim Pierce at the Federal Reserve. LI measures the potential losses that a financial institution could suffer from a sudden or fire-sale disposal of assets corresponding to the amount it would receive at a fair market value established under normal market sale (Saunders and Cornett, 2006). Financing gap and the financing requirement measures liquidity risk exposures by determining the depository institutions’ financing gap. Financing gap is defined as the difference between an institution’s average loans and average deposits (Saunders and Cornett, 2006). In an empirical study on bank liquidity risk and bank performance, (Alzorqan, 2014) used two ratios: current ratio and loans to deposits ratio for measuring liquidity risk of banking system of Jordan. In a similar type of study conducted in Bangladesh (Abdullah and Jahan, 2014) used loan-deposit ratio, deposit-asset ratio and cash- deposit ratio for measuring liquidity risk. (Shen et al., 2009) mentioned that previous studies used liquid assets to total assets ratio, liquid assets to deposits ratio, liquid assets to customer and short term funding ratios for liquidity risk measurement. However (Shen et al., 2009) adopted financing gap measures for measuring liquidity risk suggested by (Saunders and Cornett, 2006).

Banks’ Performance: Banks’ performance generally can be recognized as its stability and profitability (Toutou Jonattan and Xiaodong, 2011). The authors have explained stability with risk factors and profitability with financial return. Since the development of risk and return theory created by (Bowman, 1980), number of studies used different accounting ratios to measure risk and return within corporate finance concentrated on risk and return relationship between accounting variables from firm’s financial report (Nickel & Rodriguez, 2002). (Alzorqan, 2014) highlighted in his study that profit is the bottom line or ultimate performance result showing the net effects of bank policies and activities in a financial year. The scholar further added that banks’ stability and growth trends are the best summary indicators of a bank’s performance in every situation. In his study he talked about the measurement of profitability. In this author’s opinion, profitability is usually measured by all or part of a set of financial ratios. Here, key indicators include the return on average equity (ROE) and the return on assets (ROA). ROE measures the rate of return on shareholder investment and ROA measures the efficiency of use of the bank’s potential. (Athanasoglou et al., 2005) claimed that bank profitability is the ability of a bank to generate revenue in excess of cost. A sound and profitable banking sector is more likely to withstand negative shocks and contribute to the stability of the financial system. To talk about the measurements of the performance of banks (Mishkin and Eakins, 2006) stated in their book that to understand how well a bank is doing, bank’s income statement should be viewed at first. The description of the sources of income and expenses affects a bank’s profitability. Difference between net operating income and net operating expenses is called net operating income. Net operating income is intimately watched by bank managers, shareholders, and regulators because it indicates how well the bank is doing on an ongoing basis. However the authors also marked that though net income gives an idea of how well a bank is doing, it suffers from one major limitation as it does not adjust for the bank’s size, thus making it hard to compare how well one bank is doing relative to another and suggested to use return of assets (ROA), return of equity (ROE) and net interest margin (NIM) to measure banks’ performance. In order to define profitability ratios (Investopedia, 2016) marked the ratios as financial metrics that are used to assess a business’s ability to generate earnings compared to its expenses and other relevant costs incurred during a specific period of time. For most of these ratios, having a higher value relative to a competitor’s ratio or relative to the same ratio from a previous period indicates better performance. According to this website, profitability ratios are profit margin, return on assets (ROA) and return on equity (ROE).

Measurement of Variables: For this study two indicators have been used for measuring the dependent variable bank performance. The indicators are rate of return on investment (ROE) and rate of return on asset (ROA). In simple terms, ROA is a measure of profit per dollar of assets. It is an indicator of how profitable a company is in terms of its assets. Sometimes, it is referred as “Return on Investment”. ROA is expressed in percentage. The formula of ROA is:

![]()

ROE is a measures profitability of a company by revealing how much profit a company generates with the invested money of shareholders. It is expressed as a percentage and calculated with the following formula:

![]()

In this study, three independent variables have been used for measuring liquidity in banks. The variables are current ratio (CR), loan to deposit ratio (LDR) and liquid asset to total asset ratio (LATAR). Current ratio measures whether a company’s short term assets are readily available to pay off its short term liability. Short term assets are like cash, cash equivalents, marketable securities and inventory whereas short term liabilities involve notes payable, current portion of debt, payables etc. Formula of current ratio:

![]()

Loan to deposit ratio (LTD) is used for assessing a bank’s liquidity by dividing the bank’s total loans by its total deposits. LTD is expressed as a percentage.

![]()

Liquid asset to total asset ratio (LATAR) is an important liquidity management tool to assess on ongoing basis the extent liquid assets can support its asset base (Kdid, 2008). LATAR is expressed with the following formula:

![]()

Research Hypotheses: Following hypotheses have been formed on the basic of previous literature and tested to meet the research objectives.

H1 = There is a relationship between current ratio and performance of banks.

H2 = There is a relationship between loan to deposit ratio and performance of banks.

H3 = There is a relationship between current ratio and performance of banks.

METHODOLOGY

The population of the study involves 56 scheduled banks of Bangladesh and from them ten scheduled banks have been selected for the study. In similar study in (Ghana Lartey et.al, 2013) took seven listed banks and in Jordan, (Alzorqan, 2014) took two banks out of twenty three banks (Arif and Anees, 2012) included 22 banks and (Azureen et.al, 2015) used data of 21 banks. The sample banks include AB Bank Ltd, Agrani Bank Ltd, BRAC Bank Ltd, City Bank Ltd, Janata Bank Ltd, Mutual Trust Bank Ltd, Prime Bank Ltd, Pubali Bank Ltd, Standard Bank Ltd and United Commercial Bank Ltd. The study has been conducted based on secondary data which were collected from the financial statements of the banks published in websites to actualize objective of this study. Financial data has been collected from the years of 2010 to 2015. Besides, other published documents, books, journals, newspapers, web documents have been reviewed. Multiple regression analysis has been applied to find relationship between dependent variable and independent variables. Regression analysis is a statistical process for estimating the relationships among variables. It includes many techniques when the focus is on the relationship between a dependent variable and one or more independent variables. Regression analysis further helps to understand how the typical value of the dependent variable changes when any one of the independent variables is varied, while the other independent variables are held fixed.

ANALYSIS & FINDINGS

Descriptive Statistics: The study has covered the period of 2010-2015 for 10 commercial banks of Bangladesh. Descriptive statistics of return on asset (ROA), return on equity (ROE), current ratio (CR), loan to deposit ratio (LDR) and liquid asset to total asset ratio (LATAR) are presented in Table 2.

| Particulars | Minimum | Maximum | Mean | Std. Deviation |

| Return on Asset | -.0492 | .1903 | .020505 | .0391879 |

| Return on Equity | -2.5969 | .3077 | .089275 | .3685823 |

| Current Ratio | .80 | 2.21 | 1.1498 | .22047 |

| Loan to Deposit Ratio | .5564 | 7.2245 | .914218 | .8339105 |

| Liquid Asset to Total Asset Ratio | .1983 | .5224 | .293107 | .0733609 |

Source: Author Calculation

Mean ROA of the banks of Bangladesh is 2.05%. Though (Investopedia, 2006) mentioned that ROA should not be less than 5%, for banks and financial institutions a rate 1.5% or more is considered good. So mean ROA of the banks is satisfactory. However, average ROE of the banks is 8.93% which is relatively low because on an average ROE around 15% or more is mentioned as good by Investopedia. Current ratio for the commercial banks of Bangladesh is 1.1498 on an average. Rule of thumb of current ratio is 2:1 but for commercial bank 1.1498 is satisfactory. Traditionally loan to deposit ratio in between 80% – 90% is considered ideal (Investpedia, 2009). Average LDR of Bangladeshi commercial bank is 91.42% which is higher than the standard. It indicates that the banks are relying on the deposits to finance the loan and it further indicates lower level of liquidity for the banks. An average liquid asset to total asset is 29.31%. It means that liquid assets of the banks represent more than a quarter of the total assets of the banks. The study has found that banks have an average of 25.8% liquid assets of total assets which indicate that about a quarter of banks’ total assets are comprised of liquid assets. (Bordeleau and Graham, 2010) mentioned that there is no standard ratio of liquid asset holding.

| Variables | Standardized Beta |

| Current Ratio | .013 |

| Loan to Deposit Ratio | -.215** |

| Liquid Asset to Total Asset Ratio | -.387** |

| R square | .892 |

| F value | 153.764** |

*p<.05, **p<.01

Regression statistics shows that R square is 0.892 which signifies that the independent variables are capable to explain 0.892 percent variation of dependent variables. So, current ratio, loan to deposit ratio and liquidity asset to total asset ratio contribute 89.2 percent changes of banking performance. It also reveals that current ratio, loan to deposit ratio and liquidity asset to total asset ratio have relations with bank performance so the hypotheses (1, 2 &3) are accepted. Regression results shows that loan to deposit ratio and liquid asset to total asset ratio have statistically significant relations with bank performance.

RESULTS & DISCUSSION

This study has been designed intending to investigate relationship between liquidity and performance of commercial bank of Bangladesh based on secondary data. The findings demonstrate that liquidity has relationship with bank performance. It has found a negative impact of loan to deposit ratio on bank performance. It simply indicates that increase in loan to deposit ratio has negative impact on bank performance. The reason behind such findings can be explained by saying that high loan to deposit ratio means inadequate liquidity by banks. Such illiquidity may cause delay in customers’ demand. Consequently, customers may discontinue transaction relationship with the particular bank. However, this finding is different from the findings of some other scholars. (Alzorqan, 2014) found a positive relationship between loan to deposit ratio and bank performance whereas (Azureen et.al, 2015) found no significant effect of loan to deposit ratio on bank performance. A negative relationship has been found between liquid asset to total asset ratio and bank performance. It indicates that holding high quality liquid asset is disadvantageous towards bank performance. As holding of liquid asset increases, banks’ profitability gets negative effect. So, banks need to be very careful to maintain liquid assets so that bank performance can be positively affected. This finding conforms to the finding of (Azureen et. al., 2015) and (Alshatti, 2015). Those studies concluded with a negative relationship between liquid asset to total asset ratio and bank performance. It has been identified that current ratio has no significant impact on bank performance. However, loan to deposit ratio and liquid asset to total asset ratio has significant contribution in bank performance. These two ratios have negative relationship with bank performance which means the lower the loan to deposit ratio and liquid asset to total asset ratio, the higher the ROA and ROE of banks.

CONCLUSION

This study is expected to contribute in the banking literature as the study has put focus on an important issue of banking. As financial system of Bangladesh is dominated by the banking sector, this type of study can encourage more research on different types of risks and performance of commercial banks which will show more light on banking sector. On the other hand, as liquidity management is a major concern for bank authority, the findings can be considered focal point in taking decision on the level of maintaining liquid asset of the banks. Moreover, the findings of the study clarify that while investing the investors should not ignore liquidity level of the banks as long as profit is the major motive. The finding of the study is not free from limitations. This study has been done taking a few indicators of performance and only five years of data. Future study should be designed taking more indicators and more data for ensuring robust relationship between liquidity and performance in banking sector of Bangladesh.

References

- Abdullah, M. N. & Jahan, N. (2014), “The impact of liquidity on profitability in banking sector of Bangladesh: a case of Chittagong stock exchange”, EPRA International Journal of Economic and Business Review”, Vol. 2, No. 17, pp. 17-22.

- Allen, F. & Gale, D. (2000), “Financial Contagion”, Journal of Political Economy, Vol. 108, No. 1, pp. 1-33.

- Alzorqan, S.T. (2014), “Bank liquidity risk and performance: An empirical study of the banking system in Jordan”, Research Journal of Finance and Accounting, Vol. 5, No. 12, pp. 155-164.

- Amengor, E. C. (2010), “Importance of liquidity and capital adequacy to commercial banks”, A paper presented at induction ceremony of ACCE, UCC Campus.

- Annual Report of AB Bank, Agrani Bank, Bangladesh Bank, BRAC Bank, City Bank, Janata Bank, Mutual Trust Bank, Prime Bank, Pubali Bank, Standard Bank, United Commercial Bank from 2010 to 2015.

- Arif, A. & Anees, A. N. (2012), “Liquidity risk and performance of banking system”, Journal of Financial Regulation and Compliance, Vol. 20, No. 2, pp. 182 – 195.

- Athanasoglou, P. P., Brissimis, S. N., & Delis, M. D. (2005), “Bank-specific, industry-specific and macroeconomic determinants of bank profitability,” Journal of International Financial Markets, Institutions and Money, Vol. 18, No. 5, pp. 121-136.

- Azureen, N., Rahman, A. & Saeed, M.H., (2015), “An empirical analysis of liquidity risk and performance in malaysia banks”, Australian Journal of Basic and Applied Sciences, Vol. 9, No. 28, pp. 80-84.

- Bains, L. (2010) “Definition of causal research”, available at http://bertamigua1976.atspace.co.uk/causal-research-design-definition-216691.html(accessed 25 October 2016).

- Basel Committee on Banking Supervision (2006). Risk management practices and regulatory capital: cross-sectional comparison.

- Bordeleau, E. and C. Graham, (2010), “The impact of liquidity on bank profitability”, Working Paper, Bank of Canada.

- Bowman, E. H. (1980), “A risk –return paradox for strategic management”, Sloan Management Review, Vol. 21, pp. 17-31.

- Central Bank of Barbados (2008), Liquidity risk management guideline, bank supervision department, Central Bank of Barbados, Bridgetown.

- Decker, P. A. (2000), “The changing character of liquidity and liquidity risk management: A regulator’s perspective”, The Journal of Lending & Credit Risk Management, May, 2000, pp. 26-34.

- Diamond, D. W. & Rajan, R. G. (2001), “Liquidity risk, liquidity creation, and financial fragility: A theory of banking”, The Journal of Political Economy, Vol. 109, No. 2, pp. 287-327.

- Goddard, J., Molyneux, P., & Wilson, J. O. (2009), “The financial crisis in Europe: Evolution, policy responses and lessons for the future”, Journal of Financial Regulation and Compliance, Vol. 17, No.4, pp. 362-380.

- Holmstrom, B. & Tirole, J. (2000), “Liquidity and risk management”, Journal of Money Credit and Banking, Vol. 32, No.3, pp. 295-319.

- Imbierowicz, B. & Rauch, C. (2014), “The relationship between liquidity risk and credit risk in banks”, Journal of Banking and Finance, Vol. 40, pp. 242-256.

- Jenkinson, N. (2008), Strengthening regimes for controlling liquidity risk, Euro Money Conference on Liquidity and Funding Risk Management, Bank of England, London.

- Kdid (2016), “Liquid assets to total assets”, available at: http://kdid.org/microfinance-financial-reporting-standards-draft-public-comment/r11-liquid-assets-total-assets (accessed 28 October 2016).

- Khan, M. K. R. & Syed, N. A. (2013), “Liquidity risk and performance of the banking system”, International Journal of Social Review, Vol. 11, No. 2, pp. 55-70.

- Kroszner, R.S., (2008). “Strategic risk management in an interconnected world. In speech given at the risk Management Association Annual Risk Management Conference” (Baltimore, Maryland), October, available at: http://www.federalreserve. gov/newsevents/speech/kroszner20081020a.htm (accessed 3 October 2016).

- Lartey, V.C., Antwi, S., & Boadi, E. K. (2013), “The relationship between liquidity and profitability of listed banks in Ghana”, International Journal of Business and Social Science, Vol.4, No.3, pp. 48-56.

- Mishkin, F.S. & Eakins, S.G. (2006), Financial markets and institutions: An Introduction to the Risk Management Approach, McGraw-Hill, Boston.

- Nickel, M. N. & Rodriguez, M.C. (2002), “A review of research on the negative accounting relationship between risk and return: Bowman’s paradox”, Omega, Vol. 30, pp. 1-18.

- Nikolaou (2006), “Liquidity risk concepts: Definitions and Interactions”, Social Science Research Network, No. 1008, February, 2009.

- Saunders, A. and Cornett, M. M. (2006), Financial institutions management: A risk management approach, McGraw-Hill, Boston.

- Tabari, N.A., Ahmadi, M. & Emami, M. (2013), “The effect of liquidity risk on the performance of commercial banks”, International Research Journal of Applied and Basic Sciences, Vol. 4, No.6, pp. 1624-1631.

- The Economic Times (2016), “Liquidity”, available at: http://economictimes.indiatimes.com/

Definition/liquidity (accessed 3 October 2016). - Toutou, J. & Xiaodong, X., (2011), “The relationship between liquidity risk and performance: An empirical study of banks in Europe 2005-2010”. Available at: http://umu.diva-portal.org/smash/record.jsf?pid=diva2%3A523854&dswid=-4057 (Accessed 4 October 2016).

© The Author 2016. Published by Business Review – A Journal of Business Administration Discipline, Khulna University, Khulna, Bangladesh.

Keywords