Do Demographic Factors have a Variable Influence on the Increased Usage of Mobile Banking? A Study on Khulna City

Sarif Mohammad Khan

Business Administration Discipline, Khulna University

Md. Anwar Hossain

Department of Marketing, University of Dhaka

Md. Mourtuza Ahamed

Business Administration Discipline, Khulna University

Alok Kumar Sana

Business Administration Discipline, Khulna University

Khulna University Business Review – A Journal of Business Administration Discipline, Khulna University, BD

Volume 11, Number 1 & 2, January to December 2016, Pages 1-8

DOI: 10.35649/KUBR.2016.11.12.1

Published: May 2018

Published Online: July 2019

Abstract

Purpose: This paper attempts to identify the variables affect on increase in usages of mobile banking and how these variables affect on them due to the variation of gender, age, education and occupation.

Design/methodology/approach: Through literature review some factors have identified and after pilot survey the factors have been finalized. Purposive sampling technique has been used and the sample size is 100. A structured questionnaire with 5 point likert scale has been used to interview the respondents. Descriptive statistics (mean) is used to analysis the data and rank order the variable based on the mean value.

Findings: The rapid increase in mobile phone users and increasing in attractiveness of mobile banking services in Bangladesh is giving opportunity to the banks to tap into the market previously untouched. People of different age, income, education, occupation etc. are using mobile bank in Bangladesh as because of Fast (instant) service, availability, easier to use, faster, and very cost-effective service than traditional banking. Fast (instant) service is considered as the most important variable irrespective to the variation of gender, age, education, occupation and income.

Research Limitations: This research is limited to the mobile banking sector in Khulna city with a sample size of 100 and only descriptive statistics are used for analyzing the data. Thus, the results may not be generalized and further comprehensive study in this regard can be conducted.

Practical implications: The policy maker of the mobile banking industry may find some insight regarding demographic variables affecting the usages of mobile banking.

INTRODUCTION

Mobile banking is an application of m-commerce which enables customers to access bank accounts by using mobile devices to perform banking transactions such as checking account statuses, transferring money and selling stocks etc. (Kim et al., 2009). Luo et al. (2010) defined mobile banking as a creative way of banking whereby the customer interacts with a bank through a mobile phone. Wu and Wang (2005) found that perceived risk, compatibility and perceived usefulness have significant influences on using mobile banking than the cost whereas Liza (2014) found that cost has a very significant role in choosing mobile banking. Mattila et al. (2003) identified that the increasing in usages of mobile banking has highest influenced by the costs and faster data transmission was accounted to the secondly highest importance. Cheah et al. (2011) argued that factors such as perceived usefulness, perceived ease of use, relative advantages and personal innovativeness were found positively related with the intention to increase the use of mobile banking services. Fear of inadequate security is one of the factors that have been identified as impediment to the growth and development of mobile banking including electronic banking adoption (Aderonke, 2010). Anyasi and Otubu (2009); Malando Lugisi (2015), have shown the economic effect of mobile banking and found out that it is offering various services to its customers, at least managing money without handling cash. They have also got the great scope of extending mobile banking business to contribute to the economic development. Ivatury and Mas (2008) have argued that branchless banking can dramatically reduce the cost of delivering financial services to the poor. Malhotra (2012) has identified that technology, security, usability, cost etc. have significant influence in the acceptance of mobile banking.

Deb et al. (2011) conducted a study named “the dimensions affecting the adoption of mobile banking in Bangladesh” and found that some factors – convenience, cost, security, confidentiality and network made the mobile banking service easy for the people of Bangladesh. Laforet and Li (2005) indicated that the issue of security was found to be the most important factor that motivated Chinese consumers’ adoption of online banking. Yang (2009) explored university student in Taiwan adapting mobile banking as it is fulfilling personal banking needs, provides location free conveniences, and is cost effective. (Clark, 2008) suggested mobile banking is giving consumers more low-cost self-service options to access funds, banking information and make payments. Laukkanen and Pasanen (2008) found that age and education have a major influence on the use of the mobile phone in banking services. Bamoriya and Singh (2011) suggests that providing adequate protection for consumers, security of transactions and know-your-customer principles is important for mobile payments. Comninos et al. (2008) suggest that convenience and security are the prerequisite for electronic transaction (online/mobile banking). Bamoriya and Singh (2011) found that Indian mobile banking users are specially concern with security issues like financial frauds, account misuse and user friendliness issue difficulty in remembering the different codes for different types of transaction, application of software installation & updating due to lack of standardization. Heyer and Mas (2011) found that mobile banking assist people in many ways by increase convenience through dropping travelling and line up times; increase safety of transactions for users; give the user a greater control on where to transact, which helps to protect privacy and reduce corruption. Kshetri and Acharya (2012) identify socio-economic conditions, rapid diffusion of mobile phones, increased efficiency and lower costs, convenience and new initiatives as driving factors in a mobile payments system. Perceived credibility is a determinant of behavioral intention to use an information system. Perceived credibility consists of two important elements: privacy and security (Amin, 2007). Security refers to the protection of information or systems from unauthorized intrusions (Aderonke, 2010). Fear of inadequate security is one of the factors that have been identified as impediments to the growth and development of mobile banking including electronic banking adoption (Aderonke, 2010).

According to Donner and Tellez (2008), Mobile banking is a new invention for unmet demand of the customers especially for the poor. They have emphasized for mobile banking regulation to avoid some risks, banks and telecommunications face such as liquidity risk, credit risk, privacy risk, inoperability risk etc. They think regulation will help reduce the risk level and the institutions reach the top of the industry, but regulation should not minimize the benefits of mobile banking. Parvin (2015) demonstrated that the branchless banking can dramatically reduce the cost of delivering financial services to the poor. Laforet and Li (2005) investigated the market status for mobile banking in China. With the recent and forecasted high growth of Chinese electronic banking, it has the potential to develop into a world-scale internet economy and requires examination. Mattila (2003) specified the factors influencing adoption of mobile banking services such as costs, data transmission, authentication with mobile phone to internet bank, possibility to conduct banking truly regardless of time, place, and curiosity towards using the services. Kim et al. (2009) confirmed that three variables relative benefits, propensity to trust and structural assurances had a significant effect on initial trust in mobile banking. Also, the perception of initial trust and relative benefits was vital in promoting personal intention to make use of related services.

Yang (2009) explored factors associated with adopting and resisting mobile banking technologies among university students in Taiwan. Adoption factors determined in the study includes the belief that mobile banking helps fulfill personal banking needs, provides location free conveniences, and is cost effective. The primary factors associated with resistance which were discovered included concerns over system configuration security and basic fees for mobile banking web connections. Heyer and Mas (2011) illustrated that mobile money should at a bare minimum assist in three ways, firstly increase convenience by reducing travelling and queuing times; secondly due to the virtual element of mobile money increase safety of transactions for users when transacting through the mobile device as it is inherent that by instantly transacting live users begin to trust the system; and finally mobile money offerings through their footprint of agents and outlets, give the user a greater control on where to transact, which helps protect privacy and reduce corruption. Heyer and MAS (2009) also identify three features of a mobile money business as volume, speed and coverage”, the combination of which suggests a highly scalable business model as momentum of transactions increases. They go on to demonstrate that latent demand, coverage and quality of existing alternatives, openness of regulation, quality of retail infrastructure and market landscape are key to assessing a country’s readiness for mobile payments / mobile money offerings.

OBJECTIVES OF THE RESEARCH

The objective of the paper is to determine the factors influencing the increase in uses of mobile banking services in Bangladesh especially in Khulna and how these factors vary due to the variation of some selected demographic variable like age, sex, education, occupation & income.

METHODOLOGY

The research is descriptive in nature. To identify the variables affecting on the increase in uses of mobile banking extensive literature is reviewed and pilot survey has been conducted. Primary data has been collected from the responded through personal interview with a structured questionnaire. Purposive sampling technique has been used to select the respondent and the sample size is 100 in which 40 are female and 60 are male. Clients of DBBL-mobile banking and b-kash customers in Khulna city are interviewed for the purpose of the study. This research targeted mobile banking users of different age, sex, level of education and occupation.

The questionnaire is divided into two parts. First part contains the selected demographic variables as name, age, sex, occupation and income of mobile banking users and the 2nd part of the questionnaire contains questions to decide mobile banking service uses criteria. The second part includes 12 close ended questionnaires of 5 point’s likert scale where 1 indicates strongly disagree, 2 for disagree, 3 for neutral, 4 for agree, 5 for strongly agree. Descriptive statistics has been used to analyze the data. Mean value is calculated for each of the factors against each of the selected demographic variable (age, sex, education, occupation and income) and a rank of order (from highest to lowest) is prepared according to the mean value of the factors. The calculated highest mean value of each factor against each of the demographic variable is considered most important factor where as the calculated lowest mean value with associated factor is considered least important factor and for rest of the variable the higher the value the more important the variable is. A rank order (from highest to lowest) is prepared according to the mean value of the factors against each of the demographic variable. Result of the analysis is presented by using table and graph.

ANALYSIS & FINDINGS

Gender Based Analysis: In the below mentioned table (table 01) represented information about the mean value of the factors impact on increase in usages of mobile banking based on gender.

Table 01: Mean Value based on Gender

| Factors | Gender | Overall | |

| Male | Female | ||

| Fast (instant) services | 4.38 | 4.44 | 4.41 |

| Easy registration | 4.15 | 4.39 | 4.27 |

| Service availability | 4.32 | 4.13 | 4.22 |

| Easy transaction process | 4.34 | 4.09 | 4.21 |

| Safety and security | 3.85 | 4.04 | 3.95 |

| Hassle-free services | 3.89 | 3.96 | 3.93 |

| No hidden charges | 3.83 | 3.83 | 3.83 |

| Faster than traditional bank | 3.70 | 3.78 | 3.74 |

| Perceived usefulness | 3.45 | 3.13 | 3.29 |

| Cost effectiveness | 3.06 | 3.04 | 3.05 |

| Meeting requirement | 3.09 | 2.91 | 3.00 |

| Employee behavior | 3.00↓ | 2.87↓ | 2.94 |

It is observed from the table-01 that fast (instant)) services is considered as the most influencing factor to both male and female for using mobile banking where as employee behavior is considered as least influencing variable. It is also observed that the male respondents are positive than female respondent with service availability, perceived usefulness, easy transaction, employee behavior & cost effectiveness where as the female respondents are more positive that male respondent with safety and security, hassle-free services, easy registration & fast (instant)) services. Both male and female respondents show uniqueness with their response with the variable of no hidden charges of mobile banking.

Age Based Analysis: In the below mentioned table (table 02) represented information about the mean value of the factors impact on increase in usages of mobile banking based on different age group.

| Factors | Age group | Overall | ||

| 20-29 | 30-39 | Above 40 | ||

| Fast (instant) services | 4.45 | 4.30 | 4.50 | 4.41 |

| Easy transaction process | 4.24 | 4.33 | 4.40 | 4.33 |

| Easy registration | 4.15 | 4.26 | 4.40 | 4.27 |

| Service availability | 4.39 | 4.04 | 4.20 | 4.21 |

| Hassle-free services | 3.73 | 3.93 | 4.60 | 4.08 |

| No hidden charges | 3.49 | 4.07 | 4.30 | 3.95 |

| Safety and security | 3.97 | 3.96 | 3.70 | 3.88 |

| Faster than traditional bank | 3.85 | 3.63 | 3.50 | 3.66 |

| Perceived usefulness | 3.52 | 3.30 | 3.00 | 3.27 |

| Meeting requirement | 3.09 | 3.19 | 3.00 | 3.09 |

| Employee behavior | 2.61↓ | 3.22 | 3.40 | 3.08 |

| Cost effectiveness | 3.12 | 3.00↓ | 3.00 ↓ | 3.04 |

It is observed from the table that fast (instant)) service is the most influencing factor for the age group of (20-29), easy transaction process for the age group of (30-39), and hassle-free services for the people who are above forty years old. On the other hand, employee behavior is perceived as least influencing factor to the young people who are on the age group of 20-29. Transaction cost is least attractive to the people of 30-39 years old where as people of above forty years old think perceived usefulness, cost effectiveness and capability of service providers to meet their requirement are least influencing.

Education Based Analysis: In the below mentioned table (Table 03) represented the factors impact on increase in usages of mobile banking based on level of education.

| Factors | Education | Overall | |||

| Below SSC | SSC | HSC | Graduate | ||

| Fast (instant) services | 4.44 | 4.36 | 4.35 | 4.70 | 4.46 |

| Easy transaction process | 4.56 | 4.00 | 4.23 | 4.65 | 4.36 |

| Service availability | 3.78 | 4.18 | 4.27 | 4.44 | 4.17 |

| Hassle-free services | 4.11 | 4.09 | 3.73 | 4.76↑ | 4.17 |

| No hidden charges | 4.00 | 4.18 | 3.23 | 4.38 | 3.95 |

| Easy registration | 3.25 | 3.88 | 4.12 | 4.38 | 3.91 |

| Safety and security | 3.78 | 3.82 | 4.12 | 3.75 | 3.87 |

| Faster than traditional bank | 3.44 | 3.55 | 3.92 | 3.81 | 3.68 |

| Perceived usefulness | 2.95 | 3.00 | 3.62 | 3.44 | 3.25 |

| Employee behavior | 3.56 | 2.82 | 2.54 | 3.25 | 3.04 |

| Meeting requirement | 3.22 | 2.64 | 3.08 | 2.94 | 2.97 |

| Cost effectiveness | 2.78 | 2.82 | 3.00 | 3.25 | 2.96 |

It is observed from the above table that the people of below SSC level of education are greatly influenced by the easy transaction process where as the people of SSC, HSC level of education & graduate are mostly attracted by the fast (instant) service & hassle-free services of mobile banking. On the other hand, cost effectiveness, cost effectiveness & employee behavior, employee behavior and meeting requirement are considered as least influential variable to the people of below SSC, SSC, HSC & Graduates in term of level of education respectively.

Occupation Based Analysis: In the below mentioned table (Table 03) represented the factors impact on increase in usages of mobile banking based on occupation.

| Factors | Occupation | Overall | |||

| Student | Service holder | Business-men | House-hold | ||

| Fast (instant) services | 4.29 | 4.39 | 4.44 | 4.25 | 4.34 |

| Service availability | 4.43 | 4.67 | 3.75 | 4.25 | 4.27 |

| Easy transaction process | 3.86 | 4.50 | 4.56 | 4.08 | 4.25 |

| Easy registration | 4.00 | 4.39 | 4.31 | 4.17 | 4.22 |

| Safety and security | 4.00 | 4.00 | 3.88 | 3.83 | 3.93 |

| Faster than traditional bank | 4.14 | 4.06 | 3.38 | 3.75 | 3.83 |

| Hassle-free services | 3.57 | 3.99 | 4.06 | 3.67 | 3.82 |

| No hidden charges | 3.07 | 3.83 | 4.31 | 3.75 | 3.74 |

| Perceived usefulness | 3.86 | 3.67 | 3.00 | 2.92 | 3.36 |

| Meeting requirement | 3.14 | 3.06 | 3.06 | 3.20 | 3.12 |

| Employee behavior | 2.79 | 3.17 | 2.94 | 2.99 | 2.97 |

| Cost effectiveness | 2.71 | 2.74 | 2.98 | 2.92 | 2.84 |

By using the information given in the above table (table-04) like the previous cases it is also tried identifying the most influencing factor and the least influencing factors affecting the usages of mobile banking based on different profession. It is observe that the students and service holders show the same attitude as service availability is the most important factors to them where as both service availability & fast (instant) services to the households and easy transaction process is considered as the most important factor to the business men. On the other hand, students, business men & households are highly negative about the cost effectiveness as they marked it as least influencing factors but business men marked employee’s behavior & cost effectiveness as the least 2nd least influencing factor.

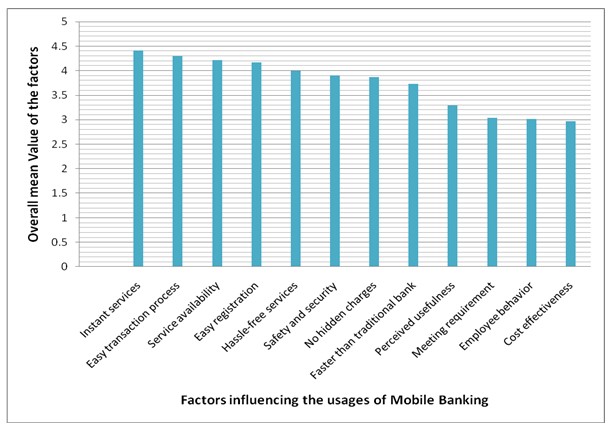

Overall Analysis: In the below mentioned table (table -05), factors are ranked ordered from most influential to least influential on increase in usages of mobile banking based on overall mean value of all dimensions (age, gender, occupation & education).

| Factors | Gender based | Age based | Education based | Occupation

Based |

Overall* | Rank order |

| Fast (instant) services | 4.41 | 4.41 | 4.46 | 4.34 | 4.41 | 1 |

| Easy transaction process | 4.21 | 4.33 | 4.36 | 4.25 | 4.29 | 2 |

| Service availability | 4.22 | 4.21 | 4.17 | 4.27 | 4.22 | 3 |

| Easy registration | 4.27 | 4.27 | 3.91 | 4.22 | 4.17 | 4 |

| Hassle-free services | 3.93 | 4.08 | 4.17 | 3.82 | 4.00 | 5 |

| Safety and security | 3.95 | 3.88 | 3.87 | 3.93 | 3.90 | 6 |

| No hidden charges | 3.83 | 3.95 | 3.95 | 3.74 | 3.87 | 7 |

| Faster than traditional bank | 3.74 | 3.66 | 3.68 | 3.83 | 3.73 | 8 |

| Perceived usefulness | 3.29 | 3.27 | 3.25 | 3.36 | 3.29 | 9 |

| Meeting requirement | 3.00 | 3.09 | 2.97 | 3.12 | 3.04 | 10 |

| Employee behavior | 2.94 | 3.08 | 3.04 | 2.97 | 3.01 | 11 |

| Cost effectiveness | 3.05 | 3.04 | 2.96 | 2.84 | 2.97 | 12 |

*all the value represents the average value for each of the criteria given by the respondents.

The average value of overall mean value represents that fast (instant) service is the most influential among all the factors where as cost effectiveness is the least influential among all the factors impact on increase in usages of mobile banking. It is also observed from the table that easy transaction process, service availability, easy registration, hassle-free service are more influential (respectively 2nd, 3rd, 4th and 5th position according to rank order) factors where as safety and security, no hidden charge, faster than traditional banking, perceived usefulness, requirement fulfillment, employee behaviors are relative less significant (respectively 6th, 7th, 8th, 9th, 10th and 11th position according to rank order).

Figure 01: Most Important to Least Important Factors (From Left To Right) Based on Overall Mean Value.

The above figure (figure -01) is representing the variable according to the importance of the variables. The most influencing factors are fast (instant) service, service availability, easy transaction and easy registration. On the other hand, the least influencing factors are cost effectiveness, ability of the employees to meet the customer requirements, employee behavior and quick response from the employees.

CONCLUSION

The study reveals the factors that affect on increase in the usages of mobile banking do not widely vary based on demographic variable (selected variable took into consideration for this study purpose). The findings from all dimension of the study unveil that fast (instant) service is the most influential among all the factors for faster increase in uses of mobile banking in Bangladesh. But education based analysis focused second highest importance on easy transaction process and service availability as third highest where as occupation based analysis focused on service availability as second and easy transaction process as third highest. The findings for all other factors in all the dimensions disclose the similar message.

References

- Aderonke, A. A. (2010). An empirical investigation of the level of users’ acceptance of e-banking in Nigeria. Journal of Internet Banking and Commerce, Vol.15, No.1,pp.1-13.

- Amin, H. (2007). Internet banking adoption among young intellectuals. Journal of Internet Banking and Commerce, Vol.12, No.3, pp.1-15.

- Anyasi, F., & Otubu, P. (2009). Mobile phone technology in banking system: Its economic effect. Research Journal of Information Technology, Vol.1, No.1, pp.1-5.

- Bamoriya, P. S., & Singh, P. (2011). Issues & Challenges in Mobile Banking In India: A Customers’ Perspective. Research Journal of finance and accounting, Vol.2, No.2, pp.112-120.

- Cheah, C. M., Teo, A. C., Sim, J. J., Oon, K. H., & Tan, B. I. (2011). Factors affecting Malaysian mobile banking adoption: An empirical analysis. International Journal of Network and Mobile Technologies, Vol. 2, No. 3, pp.149-160.

- Clark, A. (2008). Mobile banking & Switching. Computers in Human Behavior, Vol.26, No.6, pp. 1598-1606.

- Comninos, A., Esselaar, S., Ndiwalana, A., & Stork, C. (2008). M-banking the Unbanked. Towards Evidence-based ICT Policy and Regulation policy paper series; 2008, Vol.1, No.4.

- Deb, S. K., Harun, M. A., & Bhuiyan, M. R. U. (2011). The dimensions affecting the adoption of mobile banking in Bangladesh. Journal of Banking and Financial Services, Vol.5, No.1, pp. 97-110.

- Donner, J., & Tellez, C. A. (2008). Mobile banking and economic development: Linking adoption, impact, and use. Asian journal of communication, Vol.18, No.4, pp.318-332.

- Heyer, A., & MAS, I. (2009). Factors Affecting Uptake of Mobile Money Services: M-Pesa in Kenya and Tanzania. Bill and MiIinda Gates Foundation, unpublished.

- Heyer, A., & Mas, I. (2011). Fertile grounds for mobile money: Towards a framework for analysing enabling environments. Enterprise Development and Microfinance, Vol.22, No. 1, pp. 30-44.

- Ivatury, G., & Mas, I. (2008). The early experience with branchless banking.

- Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, Vol.19, No.3, pp. 283-311.

- Kshetri, N., & Acharya, S. (2012). Mobile payments in emerging markets. IT Professional, Vol.14, No.4, pp. 9-13.

- Laforet, S., & Li, X. (2005). Consumers’ attitudes towards online and mobile banking in China. International journal of bank marketing, Vol.23, No.5, pp. 362-380.

- Laukkanen, T., & Pasanen, M. (2008). Mobile banking innovators and early adopters: How they differ from other online users? Journal of Financial Services Marketing, Vol.13, No.2, pp. 86-94.

- Liza, F. Y. (2014). Factors influencing the adoption of mobile banking: Perspective Bangladesh. Global Disclosure of Economics and Business, Vol.3, No.2, pp.199-220.

- Luo, X., Li, H., Zhang, J., & Shim, J. P. (2010). Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decision support systems, Vol.49, No.2, pp. 222-234.

- Malando Lugisi, P. (2015). The economic impact of m-banking on Smallbusiness development in Tanzania: The case study of Kariakoo foodstuff vendors. Mzumbe University.

- Malhotra, R. (2012). Factors affecting the adoption of mobile banking in New Zealand: a thesis presented in partial fulfilment of the requirements for the degree of Masters in Information Technology in Information Systems at Massey University, Albany campus, New Zealand. Massey University.

- Mattila, M. (2003). Factors affecting the adoption of mobile banking services. Journal of Internet Banking and Commerce, Vol. 8, No.1, pp.21-40.

- Mattila, M., Karjaluoto, H., & Pento, T. (2003). Internet banking adoption among mature customers: early majority or laggards? Journal of Services Marketing, Vol.17, No.5, pp. 514-528.

- Parvin, A. (2015). Mobile banking operation in Bangladesh: prediction of future. The Journal of Internet Banking and Commerce, 2013.

- Wu, J.-H., & Wang, S.-C. (2005). What drives mobile commerce?: An empirical evaluation of the revised technology acceptance model. Information & Management, Vol.42, No. 5, pp. 719-729.

- Yang, A. S. (2009). Exploring adoption difficulties in mobile banking services. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l’Administration, Vol.26, No.2, pp. 136-149

© The Author 2016. Published by Business Review – A Journal of Business Administration Discipline, Khulna University, Khulna, Bangladesh.

Keywords